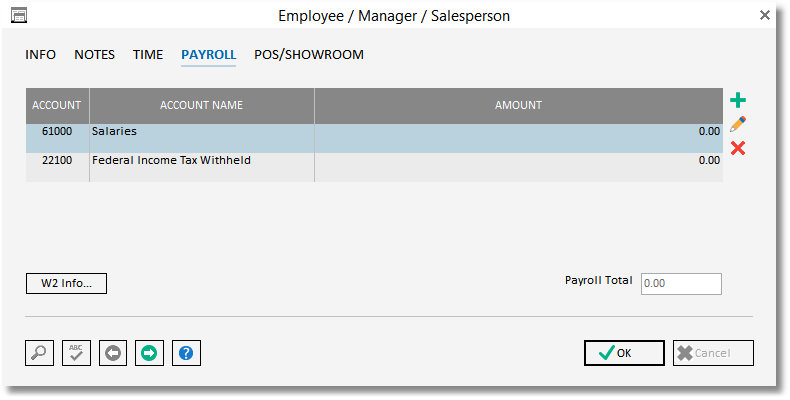

The fourth tab on the Employee / Manager / Salesperson Window is the Payroll Tab. The Payroll Tab allows you to enter the appropriate General Ledger Accounts and amounts necessary for generating a paycheck for an Employee. When adding a new Employee, all Accounts that are designated as a Payroll Account on the Account Window will be shown on the Employee Payroll Accounts Grid.

Usually there is a salary Expense Account and several deduction Liability Accounts such as federal income tax withheld. The salaries Account should be a positive amount, while the deduction Accounts should be negative amounts.

The Payroll Total beneath the grid is the sum of all Payroll Accounts for the Employee and represents the Employee’s net pay.

All amounts on this Employee Payroll Accounts Grid should be for a single pay period. For instance, if an Employee is paid weekly, then these amounts should reflect one week’s pay. Payroll checks to Employees can be generated through the Vendor Deposits, Invoices, and Operating Expenses Window. The amounts can be edited for each check generated to account for differences in payroll from period to period.

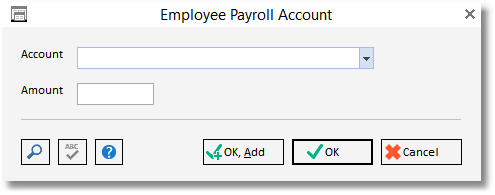

Add, edit and delete Employee Payroll Accounts by clicking on the appropriate button. Clicking on the Add or Edit buttons will open the Employee Payroll Account Window.

To delete an entry, highlight the entry and click on the Delete button.

Click the W2 Information button to input the necessary information for the Employee's W2 form on the W2 Information Window. You can print the W2 form under Accounts Payable Payroll Reports.