The 1099 Report is accessed through the Reports Window, Accounts Payable folder. This report is used to provide a list of Vendors requiring Form 1099-MISC or Form 1099-INT for tax purposes. The 1099 Report may also be used to print on the actual 1099 and 1096 Forms, the cover sheet used for transmittal of the 1099 documents.

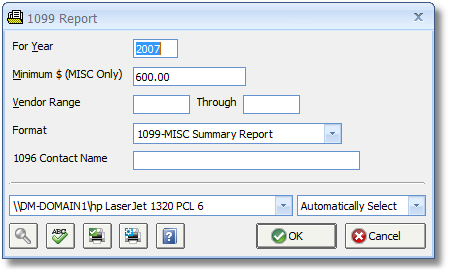

The previous year will be displayed in the For Year field and can be changed if necessary. The Minimum Dollar Amount (Minimum $) is used only for the 1099-MISC reporting and defaults to 600.00 which is the amount required by the Federal Government as of the 2007. This amount may also be changed. Next, a Vendor Code range may be optionally entered to narrow the scope of 1099 Report. Lastly, the company employee who should be contacted regarded the 1099s can optionally entered into the 1096 Contact Name field to print on that document.

The report has eight formats:

| • | 1099-MISC Summary version that lists basic information for the 1099-MISC form. |

| • | 1099-MISC Detail version that includes a list of the Checks and Vendor Invoices that comprise the amount. |

| • | 1099-MISC Forms themselves. |

| • | 1096-MISC Form for transmission of the 1099-MISC Forms. |

| • | 1099-INT Summary version that lists basic information for the 1099-INT form. |

| • | 1099-INT Detail version that includes a list of the Checks and Vendor Invoices that comprise the amount. |

| • | 1099-INT Forms themselves. |

| • | 1096-INT Form for transmission of the 1099-INT Forms. |

Both 1099 Forms and the 1096 Form can be purchased from any office supply store and must be for a laser or ink jet printer. Note: Forms sent by the IRS cannot be printed on directly because they are not made for computer printers.