Invoice Adjustments should be used for write offs or minor changes, as they do not affect the Project information. To reverse the Client Invoice, and then Invoice the Items again with the correct amounts is far more common. For more information on crediting a Client Invoice, see Reversing/Crediting a Client Invoice.

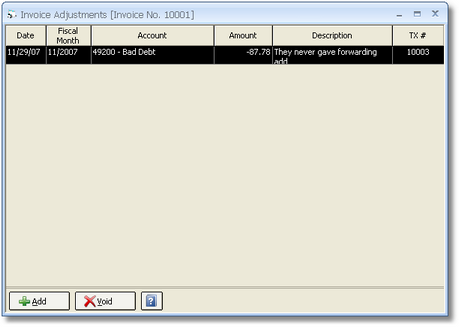

To adjust an existing Client Invoice, select A/R è Client Invoices / Finance Charges to display the Client Invoices / Finance Charges Window and click the Existing Tab on that window. Then, click the Adjust button which will open the Invoice Adjustments Window shown below.

The Invoice Adjustments Window displays all Invoice Adjustments previously created for the Client Invoice on the Invoice Adjustments Grid. The columns of the Invoice Adjustments Grid will be discussed under the Invoice Adjustment Window below as the information displayed in the columns is derived from that window.

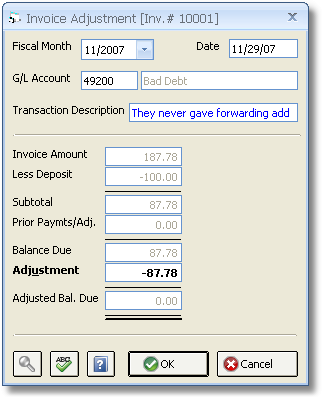

To create a new Invoice Adjustment, click the Add button to display the Invoice Adjustments Window shown below.

Fiscal Month: The Fiscal Month into which the Invoice Adjustment will be reflected.

Date: This is the date that the Adjustment which defaults to the current system date.

General Ledger Account (G/L Account): This field must contain the General Ledger Account Number that is used to record this Adjustment. The G/L Accounts should not be the Accounts Receivable Account as Design Manager will automatically adjust the Accounts Receivable Account. Rather, enter the Account Number of the Account that will be the offset to the Accounts Receivable Account. For example, if you are writing off an Invoice you might use a Write Off Expense Account. To search for an Account, click on the Search button.

Transaction Description: You may optionally add a description of the Adjustment in this field for future reference.

Invoice Amount: This is the total amount of the Client Invoice before any Deposits were applied.

Less Deposit: This is the Deposit amount that was applied to the Invoice.

Subtotal: The Invoice Amount less the Deposit Amount.

Prior Payment/Adjustments (Prior Paymts / Adj.): This field shows any Payments or Adjustments previously recorded on the Invoice.

Balance Due: The current total balance due on the Invoice prior to any new Adjustments.

Adjustment: Enter the amount by which you wish to adjust the Invoice. Use a minus (-) sign to indicate a negative amount and reduce the adjusted balance.

Adjusted Balance Due: This is the new total amount due for the Invoice after this Adjustment is accepted.

Click the OK button to record the Adjustment which will then display the Adjustment on the Invoice Adjustments Grid of the Invoice Adjustments Window.

To remove an invalid Invoice Adjustment, select the Invoice Adjustment on the Invoice Adjustments Grid and click the Void button. Upon doing so you will be asked, "Are you sure that you wish to void the highlighted Invoice Adjustment?" Clicking Yes will deleted the Invoice Adjustment and affect the Balance Due of the Invoice appropriately. Selecting No will take no effect.

Accounting: The Accounts Receivable Account is always affected upon creating an Invoice Adjustment with the Account selected in the G/L Account field being the other Account affected. Upon reducing a positive Balance Due with a negative Invoice Adjustment, the Accounts Receivable Account will be reduced or credited and the G/L Account will be increased or debited.