Design Manager’s Checkbook and Credit Card Reconciliation can accept an on-line banking file to help you to clear checks, deposits, and charges as well as spot missing items. An on-line file must be of the format .QIF and will need to be downloaded from your institution’s website for the same range of dates as the statement that you are reconciling. Store the downloaded file in a place on your computer that you can easily find it.

Note: On-line banking files are only used for matching and checking to see if all transactions are accounted for in Design Manager. These files hold no more information than the check number and the amount (usually not even the payee or vendor is included in the file) therefore they cannot be used to create transactions in Design Manager. On-line banking files may be used to create entries with programs such as Quicken or Microsoft Money because these are not order tracking systems and they do not require detailed information about the transactions. Since there is no PO information, item cost information, descriptions of goods, or expense account information in the file, importing the file (just to get the amount, maybe the vendor in some rare cases) would not be adequate. This small amount of information is fine for Quicken where the goal is just to keep track of the checks written and amounts, but the goal of Design Manager is detailed order tracking along with client billing of the purchased goods.

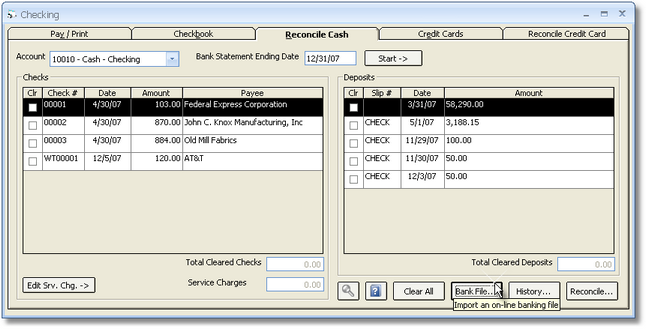

To load a banking file, you must begin either checking (cash) reconciliation or a credit card reconciliation. Choose the account and then enter the statement ending date on the Cash Reconciliation Tab or the Credit Card Reconciliation Tab of the Checking Window. Click the Bank File button below the transaction grids.

If this the first time that you have loaded a file for this statement, then the Load On-Line Banking File Window will immediately appear.

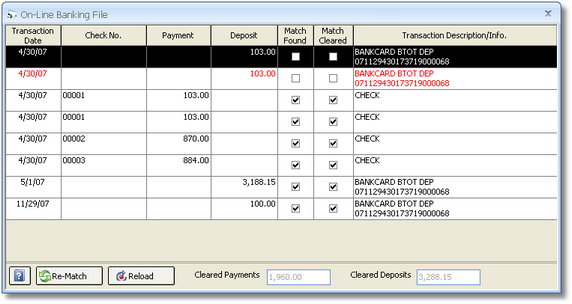

Use this window to browse to the location of the .QIF file that you downloaded from your banking or credit card institution’s website. Highlight the file and click OK. Design Manager will immediately search the transactions and try to match them up with the transactions from the file. Design Manager will place a check mark in the Match Found column when it detects a match with a transaction from your statement. Transactions that cannot be matched will show in red and will not include a check mark. Any transactions that have a match should be verified by the user by checking them against the printed statement. Once verified, place a check mark in the Match Cleared column, this will clear the transaction on your reconciliation as well.

Transactions that cannot be matched (that appear in red) either need to be matched up manually or do not exist in Design Manager. An example of transactions that may need to be match up manually may be a deposit that shows as multiple transactions in Design Manager but one transaction on the bank statement or vice a versa. Verify that these total correctly and mark them by placing a check mark in the Match Cleared column. You also need to clear these transactions manually on your reconciliation.

Transactions that are missing will need to be entered into Design Manager. To do so you may close the On-line Banking File Window and the even the Checking Window and make your entries. When you come back your reconciliation and bank file will still be just as you left it (so long as you enter the same statement ending date). The Re-match button can be used to force Design Manager to reevaluate all of the transactions by searching for matches again. This is useful if you needed to enter many missing transactions and do not want to mark them all manually. The Re-load button can be used to clear out all of the information and load an entirely new file. This button is useful if you realize that you banking file was download for the incorrect dates or you just want to start over.