The Project / Order Cash Flow Report is accessed from the Reports Window, Project Management folder and displays the movement of cash into the company from monies received from the Client and the movement of cash out of the company via payments to Vendors. To achieve this goal the report is divided into four sections: Client Retainers and Deposits, Client Invoices and Payments, Vendor Deposits, and Vendor Invoices and Payments.

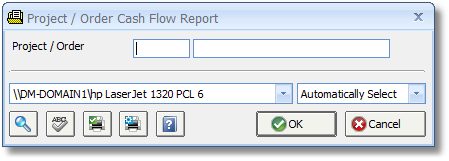

The Project / Order Cash Flow Report requires a single Project Code to be entered for which accounting activity will be displayed.

In the Client Retainers and Deposits section, the Type of transaction (either Retainer or Deposit), Proposal Number, Date, Transaction Number and Description, Client Check Number, and Deposit/Retainer Amount will be displayed for each Retainer and Deposit recorded for the Project. In the Client Invoices and Payments section, the Type of transaction (either Invoice or Payment), Client Invoice Number, Date, Transaction Number and Description, and Client Check Number are displayed. For Client Invoices, the Gross Invoice Amount, Deposit Applied, and Net Invoice are also listed while the Payment Amount is displayed for Payment transactions. Following the Client Invoices and Payments, the total Gross Invoice Amount, Deposit Applied, Net Invoice, Payments, along with the current available Client Deposit/Retainer Amount, are displayed.

Vendor Deposit payables and their associated Checks are listed in the Vendor Deposit section with columns for Type (either Vendor Deposit or Check), Purchase Order Number, Date, Transaction Number and Description, Vendor Code, and Check Number. For Vendor Deposits, the Deposit Amount is listed and, if the Deposit was paid via Credit Card, the total Payment Amount. Checks will also list the Payment Amount. In the Vendor Invoice and Payments section, Vendor Invoices and Checks are listed with columns for Type (either Vendor Invoice or Check), Purchase Order Number, Date, Transaction Number and Description, Vendor Code, and Check Number. For Vendor Invoices, the Gross Invoice Amount, Deposit Applied, and Net Invoice are also listed while the Payment Amount is displayed for Check and Credit Card transactions. Following the Vendor Invoices and Payments, the total Gross Invoice Amount, Deposit Applied, Net Invoice, Payments, along with the current available Vendor Deposit and Accounts Payable Amounts, are displayed.

Throughout all sections, the Balance columns represents the movement of cash through the Project.

The first page of the report displays the Project Cash Flow Summary which shows the total Deposits on Proposals, Payments on Client Invoices, Vendor Deposits and Vendor Invoices Paid, and any Miscellaneous Project-Related Expenses to quickly display the net effect on the company's cash flow due to the Project. The final page of the report will display any Miscellaneous Project-Related Expenses in detail for further review as these transactions cannot be listed under the Vendor Invoices and Payments section.