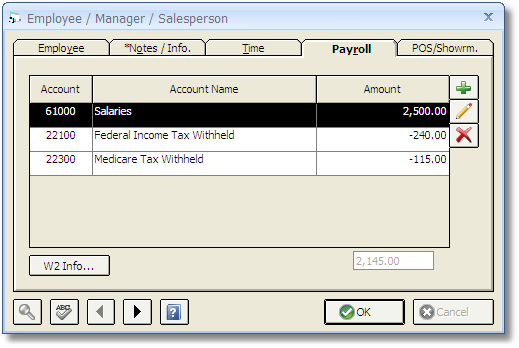

For each Employee, Payroll Accounts can be assigned on the Employee / Manager / Salesperson Window - Payroll Tab. To do so, select Glossaries è Employees / Managers/ Salespeople which will display the Employee/ Manager / Salesperson Glossary Window. Highlight the desired Employee and click Edit to open the Employee / Manager / Salesperson Window. Click on the Payroll Tab to enter payroll information for the Employee. If no Employees are listed, click the Add button to create an Employee while inputting the Payroll information. For more information on Employees, see Employees / Managers / Sales People under Glossaries.

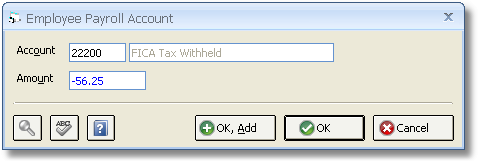

This Payroll information only needs to be set up once. Click on the Add button to add a Payroll Account and enter an Amount.

The first Payroll Account is usually a salary Expense Account and contains the gross pay for one pay period. The other Accounts are usually Liability deductions which include withholdings such as federal income tax, state income tax, social security, etc.. For the deduction Accounts, input a negative (-) sign in front of these amounts to represent the deduction. Enter as many deductions as necessary. The Payroll Total will be calculated at the bottom of the Payroll Accounts Grid and represents the Employee's net pay. If the Employee’s salary changes every period, then enter the most typical salary, as it can be overridden when the Payroll entry is created. If all of the information appears to be correct, click OK to close the Employee / Manager / Salesperson Window.