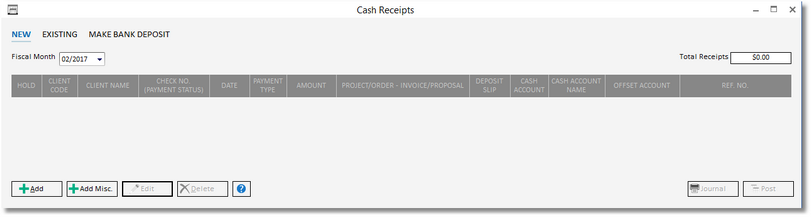

The Cash Receipts Window - New Tab is the interface to record all monies received by the company whether they have been paid via check, credit card, wire transfer, or other method.

Fiscal Month: Like all Transaction Posting Windows in Design Manager, the Fiscal Month into which the entries on the New Cash Receipts Grid will be posted is displayed in the top left corner of the New Tab. Depending on the settings on the Company Information Window - Fiscal Month Tab, the Fiscal Month will either default to the current Company Fiscal Month or to one month after the last Closed Fiscal Month. If the user has the Allow Fiscal Month Changes Password Attribute unlocked, the Fiscal Month can be changed as desired.

Total Receipts: As new Cash Receipts are added to the New Cash Receipts Grid, the Total Receipts will automatically update to display the sum of the Cash Receipts entered thus far that are not on Hold as described below.

The New Cash Receipts Grid dominates the New Cash Receipts Window and displays all unposted Cash Receipts for the current Design Manager user. Note: Each user maintains their own list of Cash Receipts on the New Cash Receipts Grid and will not view other users' Cash Receipts. Entries on this grid are grouped together by the total amount of the Cash Receipt even though the monies may be allocated to several areas. For example, the Client may have given the company a Check for 10,000.00 but that amount consists of Payments on two Client Invoices for a total of 5,000.00 and the other 5,000.00 is allocated for a Retainer. The Cash Receipt in this case will still appear as a single entry on the grid for a 10,000.00 Amount. The New Cash Receipts Grid has the following columns:

| • | Hold: The Hold column allows the user to selectively prevent a Cash Receipt from being posted upon clicking the Post button. To set a Cash Receipt on Hold, click the checkbox in this column for the desired Cash Receipt. |

| • | Client Code: The Code of the Client from whom the Cash Receipt was received. |

| • | Client Name: The Name of the Client from whom the Cash Receipt was received. |

| • | Check Number (Check No.) \ Payment Status: The optional Number of the Client's Check or descriptive phrase if another payment method was used. If the company has enrolled in Design Manager's automatic credit card processing with Tsys/Cayan, information regarding the authorization of the charge will be displayed in this column. For more information on using Design Manager with Merchant Warehouse, see Using Design Manager and a Credit Card Processor to Post Credit Card Transactions. |

| • | Date: The Cash Receipt Date as entered by the user. The Date should correspond to the date the monies were received by the banking institution to make reconciliation as easy as possible. |

| • | Payment Type: The selected Payment Type of the Cash Receipt used to properly group Cash Receipts on theAccounting - Checkbook window and to determine the appropriate Cash Account. |

| • | Amount: The amount of the Cash Receipt. |

| • | Project/Order - Invoice/Proposal: This column displays how the Cash Receipt is being allocated within a given Project. The information is displayed in the format <Project Code> - <Project Name>, <Retainer, Proposal #, or Invoice #>, <Amount>. Using the example above, the Project/Order - Invoice/Proposal column would display three entries: |

JHN02 - Johnson Mountain Home, Invoice #10000, $3500.00

JHN02 - Johnson Mountain Home, Invoice #10001, $1500.00

JHN02 - Johnson Mountain Home, Retainer, $5000.00

Note that the sum of the three individual distributions sum to the total 10,000.00 received from the Client.

| • | Deposit Slip: The optional Deposit Slip of the Cash Receipt. The Deposit Slip defaults to the Payment Type in order to easily group Cash Receipts of the same Payment Type and Date together on the Checking Window - Checkbook Tab. |

| • | Cash Account: The Account Number into which the Cash Receipt will be posted. The Account Number is determined by the selected Payment Type. |

| • | Cash Account Name: The Account Name into which the Cash Receipt will be posted. |

Add and Edit: The Add and Edit buttons will display the New Cash Receipt Window to enter a new Cash Receipt or revise the selected Cash Receipt on the New Cash Receipts Grid, respectively. Until the Cash Receipts are posted, any revisions will be done from the New Tab of the Cash Receipt Window. After posting, if a Cash Receipt needs to be edited or voided, it must be done from the Existing Tab as described later in this chapter. More information on is available under the New Cash Receipt Window below.

Delete: Upon selecting a Cash Receipt and clicking the Delete button, you will be asked "Are you sure that you want to permanently delete the current record?". Clicking Yes will remove the Cash Receipt from the New Cash Receipts Grid while selecting No will take no effect.

Journal: Click the Journal button to print the Cash Receipt Posting List Report. Note: If the Require Journals option is selected on the Company Advanced Options Window - General Tab, the Journal must be sent to the printer prior to posting the Cash Receipts. All Posting Lists always default to be sent directly to the printer rather than being displayed in the Print Preview Window.

Post: Upon clicking the Post button, you will be asked "Do you wish to post this list of Cash Receipts into <Fiscal Month>?" where <Fiscal Month> is the selected month of the Fiscal Month. Clicking Yes will post the Cash Receipts and remove them from the New Cash Receipts Grid. Selecting No will take not post the Cash Receipts, leaving them on the grid for further review, addition, or editing. Note: Unposted Cash Receipts will not be visible anywhere else in Design Manager! Only upon posting the Cash Receipts will accounting activity occur, Project information be updated, etc.