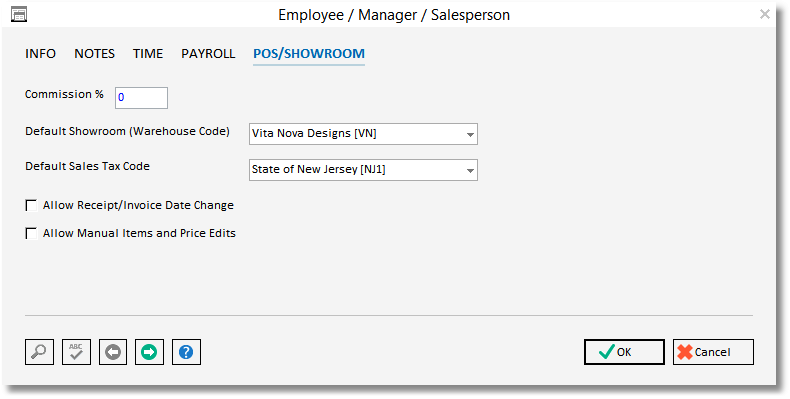

The Point of Sale / Showroom Tab is the fifth tab on the Employee / Manager / Salesperson Window and is used to properly configure the Employee to use the Point of Sale system.

Allow Receipt/Invoice Date Change: This option give the Employee the ability to change the Receipt / Invoice Date and the Fiscal Month on the Point of Sale Login Window. As the Receipt / Invoice Date determines which month the sales tax, if any, is recorded for the Point of Sale Invoice and the Fiscal Month determines into which Fiscal Period the Revenue, Sales Tax, Inventory, and other Accounts will be affected, it may be prudent to only allow select users to have this ability. If the Allow Receipt/Invoice Date Change option is not selected, all Point of Sales Invoices for the Employee will use the current system date and the current Fiscal Month of the company.

Allow Manual Items and Price Edits: The Allow Manual Items and Price Edits option grants the Employee the ability to perform two separate actions. First, the Employee will be able to create Point of Sale Items for goods or services not recorded in the company Inventory on the Point of Sale Invoice Item Window. Secondly, on the same window, the Employee will be able to change the Unit Price and Discount Percent for a Stock Inventory Item. If the option is not selected, the Employee can only use Inventory Stock Items when creating a Point of Sale Invoice and will be unable to change the Unit Price and Discount from their values on the Inventory Stock Item Window - Stock Item Tab.

Commission Percentage: The Commission Percentage is used by the Commission Report to determine the Employee's commission for all Invoices attributed to the Employee.

Default Showroom (Warehouse Code): To use the Point of Sale system, an Employee must have a Default Showroom Warehouse Code entered. The Default Showroom used determines which Warehouse Code will reflect the reduction in On Hand Quantity, Total Cost, etc. by the Point of Sale Invoices generated by the Employee.

Default Sales Tax Code: To use the Point of Sale system, an Employee must have a Default Showroom Warehouse Code entered. The Default Sales Tax Code determines the rate at which the Inventory Stock Items sold through Point of Sales Invoices by the Employee will be taxed.