After the Accounts are properly defined, you will need to create Sales Tax Codes for each tax authority to which you report. Typically there will be at least one Sales Tax Code for each state in which you do business. In some states, however, there are different rates for each county, parish, etc. In these such states, you will then need a Sales Tax Code for each such subdivision.

If you are not required to collect sales tax, a single Sales Tax Code is still required to be created as you will not be able to create a Project without an associated Sales Tax Code.

To set up your state or county, click Glossaries è Sales Tax Codes which will display the Sales Tax Code Glossary.

Clicking the Add button will display the Sales Tax Code Window in order to create a new Sales Tax Code.

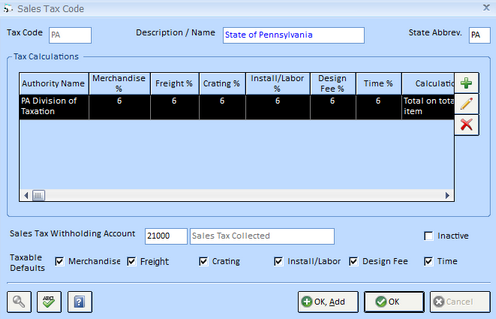

You will need to assign a Tax Code which can be up to 5 alphanumeric characters. Using the state's abbreviation is a common method (i.e., "PA" for Pennsylvania) or the first few characters of the local municipality such as "PHILA" for Philadelphia County. Next, enter a phrase into the Description / Name field to identify the Sales Tax Code. In the "PA" and "PHILA" examples, the Description / Name could be "Pennsylvania State Tax" and "Philadelphia County", respectively. The State Abbreviation is also required and is used to properly group the Sales Tax Codes when multiple entities exist within a single state, allowing the proper total for the state to be calculated.

Now, select the Account into which the sale tax is to be recorded in the Sales Tax Withholding Account. The Sales Tax Withholding Account is usually a Liability Account and it is not uncommon to have a unique Sales Tax Account for each tax authority. Beneath the Sales Tax Withholding Account are options for the Taxable status of each type of good or service. Select the option to indicate that the good or service needs to be taxed to the client. The Taxable settings will default to each Project to which the Sales Tax Code is assigned and, in turn, will default to all Specifications created for the Project.

Click the Add button to enter the proper sales tax rates on the Sales Tax Calculation Window.

Based on the requirements of the tax authority, enter the rate for each type of good or service. All rates are entered as whole number amounts such as "8.25" for 8¼ percent.

For a detailed description of Sales Tax Codes and information regarding the proper handling of more complicated tax calculations, see Sales Tax Codes under Glossary Windows.