The Profit Analysis Report is accessed from the Reports Window, Project Management folder and is designed to give both an estimated and actual profit analysis for comparison. The report lists the Estimated and Actual Costs and Prices for each Active Item in a Project.

The estimated profit is based on the estimated selling price from the Proposal and the estimated cost from the Purchase Order. The actual profit is derived from the Item price on the Client Invoice and the actual cost from the Vendor Invoice.

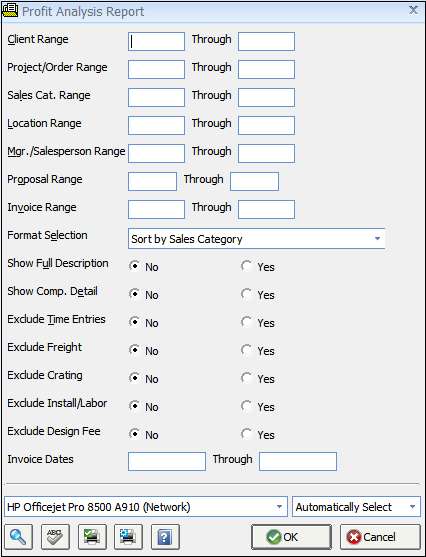

The Format Selection determines how the Items will be grouped and subtotaled within a given Project and has choices for: Sales Category, Location, Manager, Proposal Number, or Invoice Number, A Project Summary version of the report is also available which does not list each Item individually but, rather, has one line per Project so that the overall profitability all Projects can be quickly reviewed. A number of ranges are available to narrow the scope of the report including ranges for Clients, Projects, Sales Categories, Locations, Employees/Managers, Proposal Numbers, Invoice Numbers, and Invoice Dates. Further, each Component Type, not including Merchandise, can be optionally excluded from the Profit Analysis Report. The Show Component Detail option allows the cost and price information for each Component of each Item to be listed for further analysis. Please note that the report can become quite lengthy when using this option. The full Item Description can also be selectively displayed.

The following is a description of the columns on the report:

Estimate Cost: The Estimate Cost as entered by the user on the Component Window - Component Tab. The Estimate Cost of the Component is displayed on all Purchase Orders generated for the Component.

Actual Cost: The Actual Cost is automatically recorded for each Component upon entering a Vendor Invoice for the Component. The Actual Cost does not include Vendor Deposits but is the sum of all Vendor Invoices for the Component. As such, this amount will be zero until a Vendor Invoice is entered against the Purchase Order for the Component.

For example, a chair may be estimated to cost $850.00. When the Vendor sends the final invoice for the chair, incidental costs increased the total to $875.00. In this case, the Estimate Cost would be $850.00 and the Actual Cost would show $875.00.

Estimate Price: The Estimate Sell Price of the Specification as entered on the Component Window - Component Tab. The total Estimated Price of the Item is displayed when the Item is including on a Proposal for the Client. Using the example above, if the chair is estimated at $850.00 with a 30% Mark-Up Percentage, then the Estimated Sell Price would be $1105.00.

Actual Price: The Actual Price is the total amount currently invoiced to the Client and is, therefore, also referred to as the Invoice Price. The Actual Price can be the same as the Estimate Price or can reflect additional charges or discounts. The Actual Price will be zero until the Item is invoiced to the Client.

If the Invoice Pricing selection on the Project Advanced Options Window - Invoice Tab is set to Always Proposal, the Actual Price for the chair in the above example will be $1105.00 upon invoicing the Client, as the Always Proposal option uses the Estimate Price as the Invoice Price. If the Always Actual option is selected, the increases in cost incurred by the Vendor will result in a higher Actual Price to the Client as $875.00 + ($875.00 X 30%) = $1137.50. However, note that the Always Actual method is dependent on the Vendor Invoices being recorded for the goods and services. If no Vendor Invoices have been entered, the Actual Price will be zero! The Automatic setting will always use the higher of the Always Proposal versus Always Actual in order to cover any increases in Vendor cost but also allow any discounts from the Vendor to increase the profitability of the Item.

Estimate Profit: The Estimate Profit is the difference between the Estimate Price and the Estimate Cost and reflects the projected income the company will realize on the sale of the goods. In this example, the Estimated Profit would be $1105.00 - $800.00 or $255.00 profit.

Actual Profit: The Actual Profit is the difference between the Actual Price and the Actual Cost and indicates the true income the company has realized with the purchasing and selling of the goods. In the example, the Vendor invoiced $875.00 for the chair. If the chair is sold to the client at $1105.00, using the Always Proposal Invoice Pricing method, then a slightly lower Actual Profit will be recorded as $1105.00 - $875.00 = $230.00 profit.

Gross Profit Percentages: Gross Profit is the percentage of profit as compared to the price and is calculated as GP% = (Price – Cost) / Price or, more simply, Profit / Price. A 30% Mark-Up translates roughly to a 23% Gross Profit. Continuing the example above, a $255.00 Estimated Profit on a chair with an Estimated Price of $1105.00 yields a Gross Profit Percentage of is 23.1%.

Mark-Up Percentages: Mark-Up is the percentage that the cost is increased to achieve the price and is the same as the percentage that is entered for the Specifications to calculate the price from the cost. In the example, $255.00 profit is 30% of $850.00.