Sometimes you will receive money from a source other than your Clients. Likely examples of such monies is the interest you receive from the bank, commission or a finder's fee, or some sort of refund check. Money that comes into your business and is not payment for services or merchandise is known as a Miscellaneous Cash Receipt.

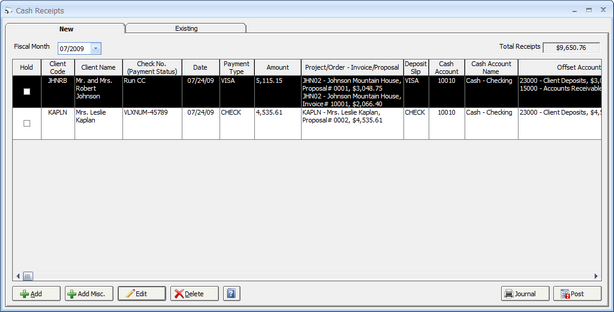

If you would like to record a Miscellaneous Cash Receipt, as you will with all Cash Receipts, select A/R è Cash Receipts which will display the Cash Receipts Window.

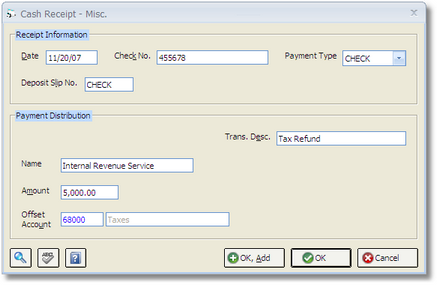

On the Cash Receipts Window, click the Add Miscellaneous (Misc.) button which will display the Cash Receipt - Miscellaneous Window shown below.

Receipt Information:

The Date will default to the current system date, but can be changed as necessary. The Date entered determines on which date the Miscellaneous Cash Receipt will appear on the Checking Window - Checkbook Tab. The Check Number (Check No.) allows you to enter the number of the Client's Check, if one is available. You can also record a transfer number, etc. in lieu of a check number depending on the mode of payment. Select the appropriate Payment Type which will automatically default into the Deposit Slip. Change the Deposit Slip if necessary.

Payment Distribution:

You can enter the Name of the person or organization from which the company is receiving the funds. Enter the amount that you are receiving in the Amount field. An optional Transaction Description regarding the cash receipt can be recorded for future reference. Finally, enter or select a General Ledger Account Number in the Offset Account field. This Account Number represents the classification of the funds you are receiving and will often be a Revenue Account. Click OK to save the Miscellaneous Cash Receipt. After the Miscellaneous Cash Receipt has been entered, it will appear on the New Cash Receipts Grid on the New Tab of the Cash Receipts Window. The Miscellaneous Cash Receipt can be edited or removed at this point by clicking the Edit and Delete buttons, respectively. To record the Miscellaneous Cash Receipt, click the Post button.

Accounting: Assuming the Amount is a positive figure, the Offset Account determines which General Ledger Account will be credited while the Checking Account of the selected Payment Type will be debited. If you enter a negative figure (i.e. –100.00) in the Amount field then Checking Account will be credited, or reduced, and the Offset Account will be debited. If you do not know what Offset Account then you may want to select the Suspense Account or verify with your accountant. The Fiscal Month to which the Miscellaneous Cash Receipt is posted is set on the New Tab of the Cash Receipts Window.