At some point after you have ordered the merchandise or paid your Vendor or Workroom, you will need to send your Client the final bill or invoice. Even if you have collected a 100% deposit, you will still need to generate an Invoice with a zero balance in order to relieve the deposit, record revenue and, if appropriate, sales tax. Client Invoices in Design Manager are similar to Proposals and Purchase/Work Orders in that you generate and print an Invoice then accept or reject it. Unlike Proposals and Purchase or Work Orders, however, accepting an Invoice will affect General Ledger Accounts. Also unlike Proposals and Purchase Orders, once a Client Invoice is accepted, it cannot be edited or revised. If you need to change the Invoice, it must be credited using the Reverse/Credit Invoice Window. Then, a new Invoice must be generated using the corrected information. Client Invoices are generated on the Documents and Accounting Window.

Select the Project for which you want to invoice and click the Client Invoice  button or right-click the Invoice

button or right-click the Invoice ![]() folder beneath the Project and select New è Invoice to Client. This will open the New Invoice Window.

folder beneath the Project and select New è Invoice to Client. This will open the New Invoice Window.

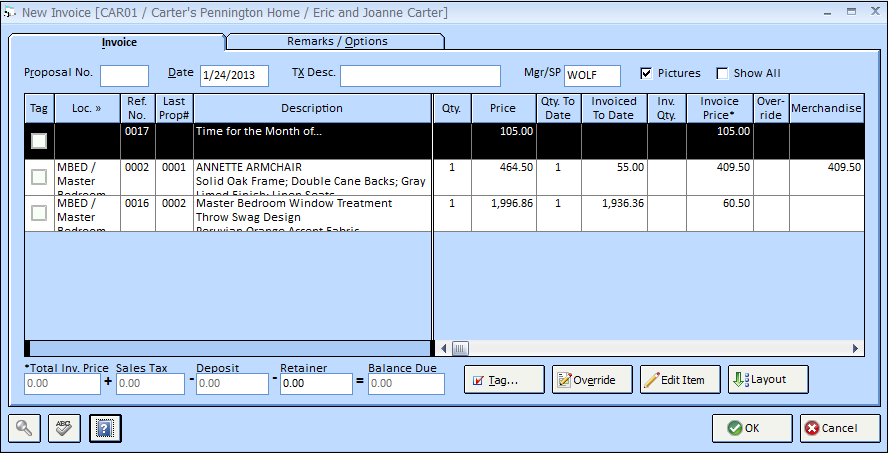

The New Invoice Window contains an Invoice Items Grid which displays all of the active Items for the Project that have not yet been included on a Client Invoice. Selecting the Show All ![]() option will display all Items within the Project including Items previously invoiced to the Client. You can input or search for a Proposal Number into the Proposal Number (Proposal No.) field which will only show Items that were included on that specific Proposal.

option will display all Items within the Project including Items previously invoiced to the Client. You can input or search for a Proposal Number into the Proposal Number (Proposal No.) field which will only show Items that were included on that specific Proposal.

You will need to “tag” or select the Items that you wish to include on the Client Invoice. You can tag Items three ways:

| • | You may simply click the box in the Tag column next to the Item you want to include on the Invoice. |

| • | If the Item is already highlighted, hit the Space Bar on your keyboard to tag the Item. |

| • | You may also press the Tag |

Once you have tagged all of the Items you wish to include, Design Manager will calculate the total amount due, including any freight or sales tax, and less any deposit the Client may have already paid at the bottom of the New Invoice Window.

![]()

You can manually utilize a Retainer on the Invoice by inputting the desired amount into the Retainer field. When all of the information appears to be correct, press OK.

For detailed information of all features on the New Invoice window see: New Invoice Window

After the Client Invoice is sent to the printer or the Print Preview Window has been closed, an Accept or Reject message will appear. Be sure to review the Invoice before accepting, as once you accept, the Invoice will be permanently recorded in Design Manager. If you need to make changes to the Invoice, press Reject. *Remember, you cannot edit a Client Invoice. To reflect any changes, you must credit the Invoice and generate it again properly.

Note: When rejecting a Client Invoices, be careful to write “Reject” on the printed copy or throw it away, so that you do not accidentally send it to the Client. If you send a rejected copy of the Client Invoice, Design Manager will have no record of it.

After the Invoice has been reviewed and accepted, it will appear on the Documents and Accounting Window within the Invoice folder for the Project. The Invoice Number, Invoice Date, Amount, Balance Due, and optional Transaction Description will be shown.

Accounting: Creating a Client Invoice will credit the Revenue Accounts as configured in the Sales Categories of the Items on the Invoices or the appropriate Sales Accounts assigned on the Company Information Window - Sales Accounts Tab if no Sales Category was assigned to an Item. For more information, see Understanding Sales Categories. The Client Deposit and Accounts Receivable Accounts will be debited and the appropriate Sales Tax Account will be credited, if necessary. In addition, the posting of a Client Invoice may trigger a transfer from the Work in Process Account to various Cost of Goods Sold Accounts if the Auto WIP Accounting option on the Company Advanced Options Window - General Tab is selected. If any Items on the Client Invoice have Vendor Invoices recorded against them then those amounts will be credited to Work in Process and debited to Cost of Goods Sold when using Auto WIP Accounting.